Navigating the EV Range Boom

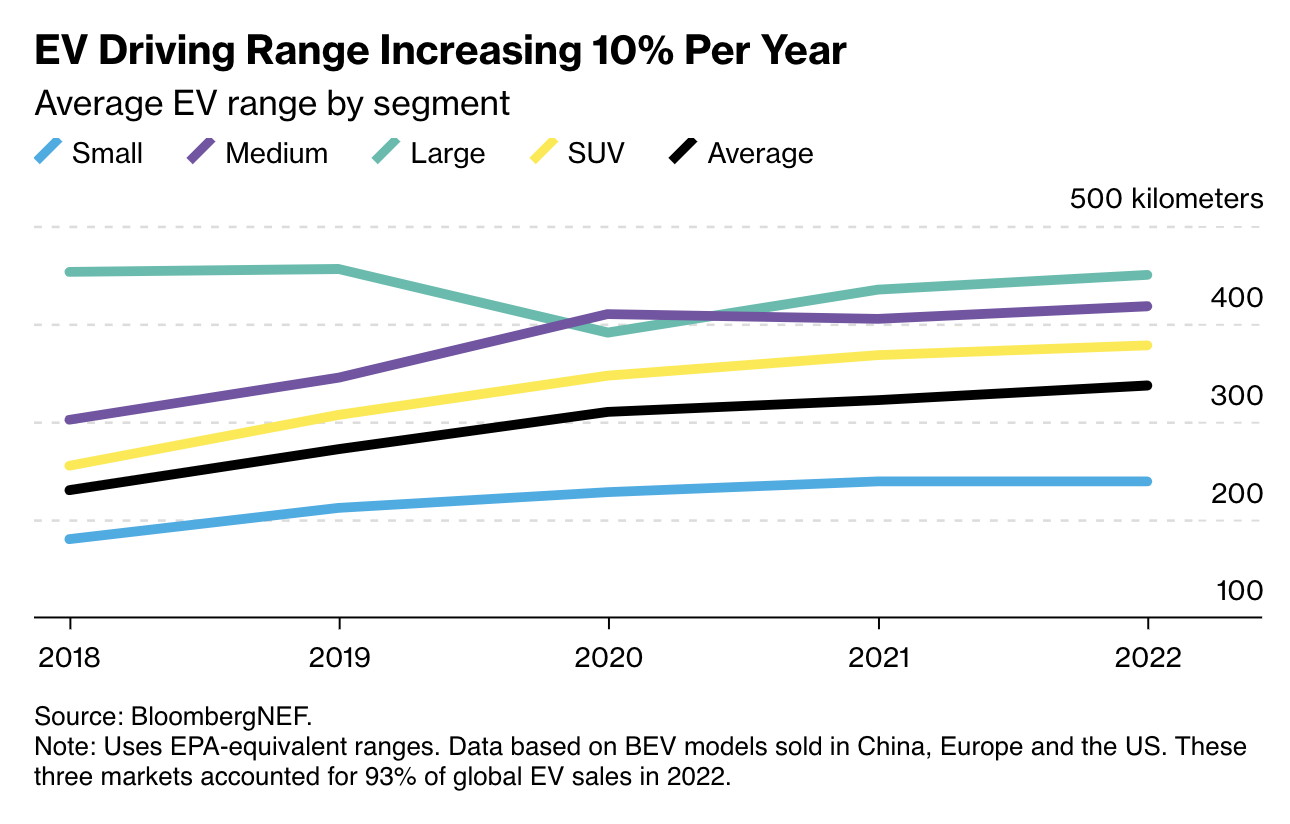

This ongoing trend seems promising from an automaker’s perspective as consumers express their desire for more range. However, if left unchecked, this unrelenting rise in range and battery-pack sizes could pose a substantial challenge for the battery supply chain.

BloombergNEF outlines three possible scenarios for the future of EV ranges. In the base case, average EV ranges will plateau in the coming years at around 250 to 310 miles, depending on the vehicle segment, while smaller city cars in markets like China, Japan, and India will remain lower. In the growth scenario, EV ranges will continue to increase by approximately 5% per year until 2030, representing a significant rise but slower than recent years. In contrast, the decline scenario predicts a 2% annual decrease in average ranges from 2025 onward, driven by improved public charging infrastructure and increased price-competitiveness.

BloombergNEF highlights the direct impact of these scenarios on battery demand and raw materials like lithium and nickel. In the growth scenario, battery demand in 2030 could be nearly 50% higher than in the base case and 70% higher than the decline scenario. This surge in demand could lead to a potential lithium market deficit and sharp price spikes, similar to what was witnessed in 2021 and 2022.

To address these challenges, the report suggests several steps for policymakers. Firstly, they should focus on providing purchase incentives for smaller, lower-priced EVs, ideally with a price cap linked to the average transaction cost in a given market. Secondly, governments should invest heavily in public charging infrastructure to demonstrate to consumers that they do not need excessive range and oversized batteries. Widespread and reliable public charging options can help eliminate the inefficiencies of over-buying range, thus reducing the pressure on the battery supply chain.

Even if policymakers are unable to curtail the rising trend, market economics will eventually play a role. As an example, the electric Chevy Silverado equipped with a 200 kWh battery pack represents a significant cost for automakers. With current battery prices, automakers may struggle to make a competitive margin, potentially slowing down the pace of EV adoption until cost-efficiencies are achieved.

In conclusion, while the remarkable growth in EV ranges and battery pack sizes is a testament to the progress of electric mobility, it also poses challenges for the battery supply chain and raw material demand. Policymakers and automakers must collaborate to strike a balance between consumer preferences for range and the feasibility of sustainable battery production to ensure a greener automotive future.

Source: BloombergNEF