EU Zero-Emission Heavy-Duty vehicle sales surge in 2023

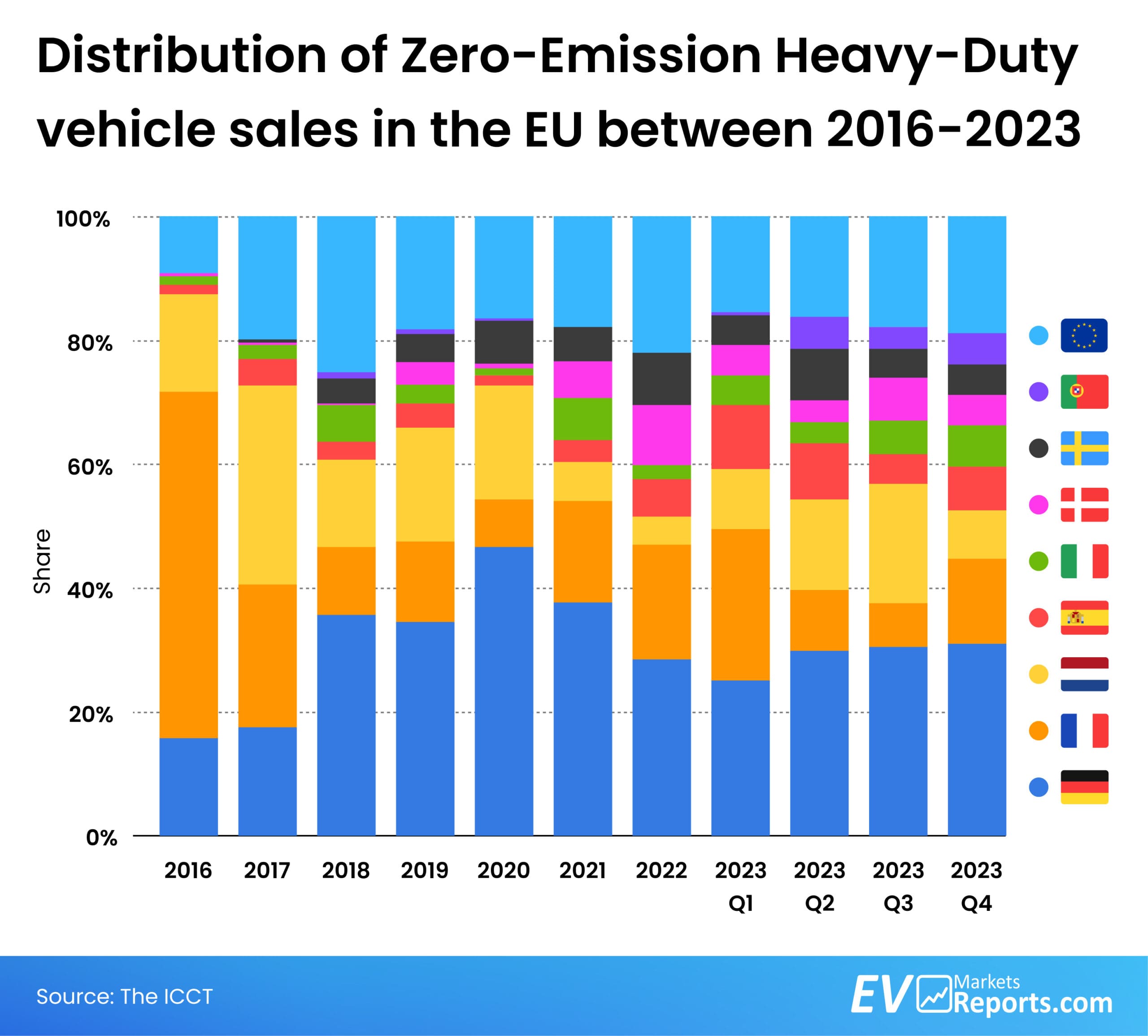

Germany, France, and the Netherlands have emerged as the leading countries in this transition, collectively accounting for 60% of the zero-emission heavy-duty vehicle market. Germany leads the pack with 30% of the sales, followed by France and the Netherlands each with 15%. Portugal showed the most remarkable growth, with sales soaring from 4 vehicles in 2022 to 400 in 2023, primarily driven by the bus sector, which now represents nearly 4% of all zero-emission heavy-duty vehicle sales in the EU.

The final quarter of 2023 alone witnessed over 3,300 new zero-emission heavy-duty vehicles being sold, a 19% increase from the previous quarter. This surge included 1,700 buses and coaches, 700 light and medium trucks, and 900 heavy trucks. Notably, the heavy truck segment exceeded a 1% sales share for the first time, indicating a growing acceptance and demand for zero-emission solutions in this traditionally more challenging market.

Mercedes-Benz led conventional heavy-truck sales, while Volvo Trucks dominated the zero-emission heavy truck market with a 42% share. The Renault 4×2 D cab, manufactured by Renault Trucks, was highlighted as the most popular zero-emission heavy truck model, with 200 units sold in 2023.

In the light and medium truck segment, sales grew by 28% from the previous year, with zero-emission vehicle sales tripling. The Ford Otosan E-Transit emerged as the top-selling zero-emission model, constituting 60% of the segment’s zero-emission vehicle sales in 2023. Germany was the largest market, with over 50% of the segment’s zero-emission sales.

Buses and coaches also saw significant growth, with zero-emission buses comprising 18% of all bus and coach sales in 2023, a 4% increase from 2022. France and Germany were the largest markets for these vehicles, underscoring their commitment to sustainable public transport options.

The report also highlighted a shift in the manufacturing landscape, with an increasing number of zero-emission heavy-duty vehicles being supplied by manufacturers outside the traditional EU-based production powerhouses. This trend is particularly evident in the bus segment, where the share of zero-emission buses made by Chinese manufacturers has risen from 10% to 30% between 2017 and 2023.

This surge in zero-emission heavy-duty vehicle sales underscores a clear and accelerating transition towards sustainable transport solutions within the EU, with significant implications for the region’s carbon emissions and air quality. As manufacturers and governments continue to invest in and incentivise zero-emission technology, the future of heavy-duty transport in Europe looks increasingly green.

Source: The ICCT