Adapting aftersales strategies for the EV revolution

BEVs signify a departure from the maintenance-intensive ICE vehicles, inherently requiring fewer mechanical services due to their simpler design and fewer moving parts. This evolution forecasts a dramatic downturn in traditional aftersales revenue streams, with authorised workshops anticipated to see a 30-45% decline in revenue per vehicle, and the parts trade facing a 20-30% reduction. The crux of the challenge lies in the diminished need for routine servicing and repairs, historically a cornerstone of customer retention and loyalty for OEMs.

The rise of BEVs also heralds a reshuffling of the automotive market landscape. With Chinese manufacturers expected to produce half of all BEVs sold globally by 2026, established OEMs face not only a contraction in serviceable vehicles but also intensified competition from new entrants. This shift underscores the urgency for OEMs to adapt their business models and aftersales strategies to remain competitive.

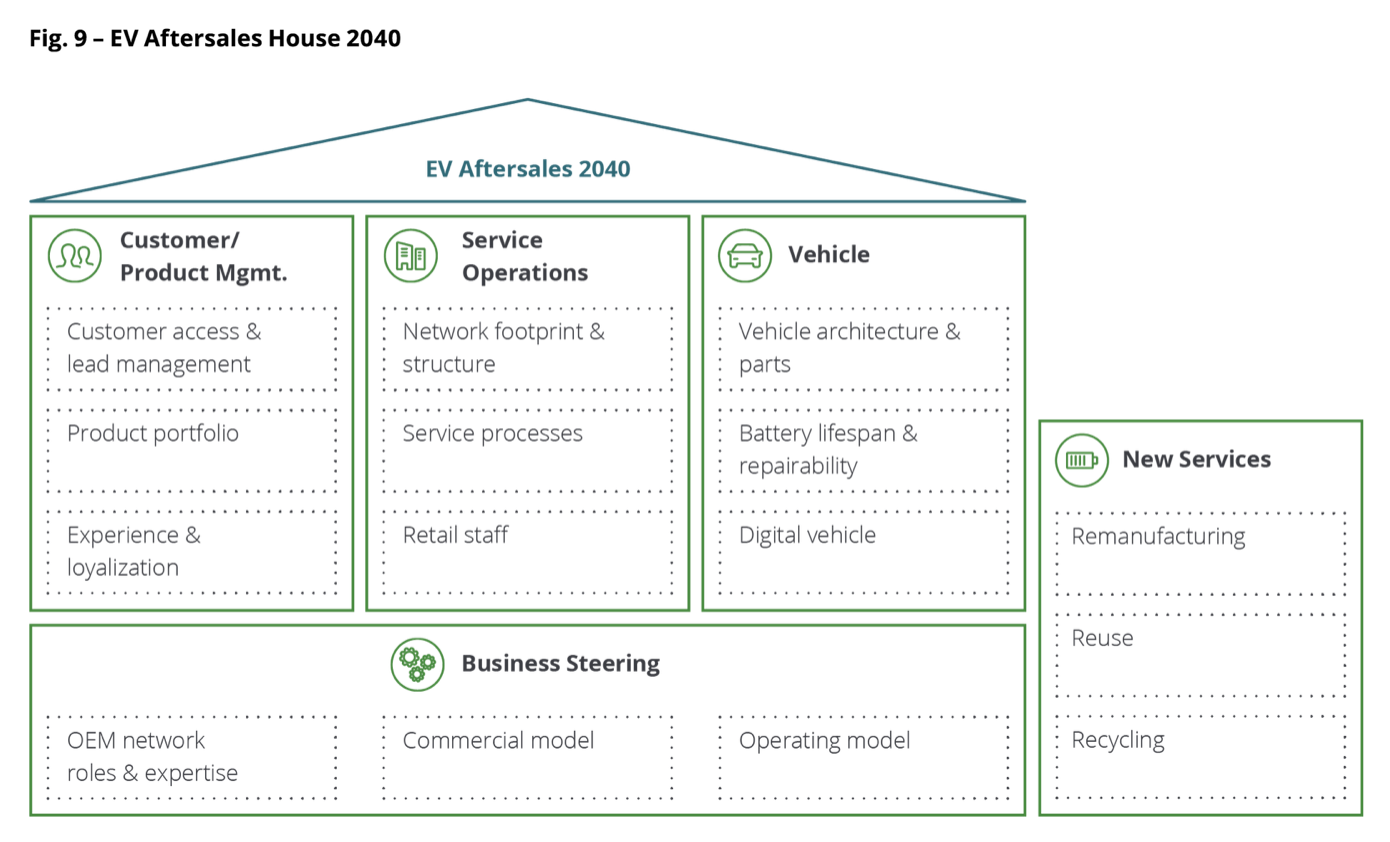

The Deloitte study advocates for a multi-faceted approach to reinvent the aftersales paradigm:

- By providing comprehensive maintenance packages for a fixed period, OEMs can offer customers peace of mind and a simplified service experience.

- Innovations such as mobile service vans, “park-and-service” points, and enhanced pick-up and delivery services can optimize service accessibility and convenience for BEV owners.

- Integrating smart diagnostics within vehicles to preemptively identify service needs can streamline the repair process and enhance customer satisfaction.

- Leveraging OTA technology for software maintenance minimises the need for physical service visits, offering a seamless and efficient solution for vehicle updates.

- Emphasising battery remanufacturing, reuse, and recycling, OEMs can not only foster sustainability but also tap into new revenue streams, mitigating the economic impacts of the transition to BEVs.

The transition to battery electric vehicles presents a complex array of challenges and opportunities for the automotive aftersales sector. As traditional revenue models face disruption, OEMs and workshops must pivot towards innovative service solutions and customer-centric strategies. Embracing technological advancements, digitalisation, and sustainability principles will be pivotal in navigating the electric future. The Deloitte study serves as a crucial guide for stakeholders across the automotive ecosystem, offering insights and strategies to thrive in the burgeoning era of electric mobility.

Source: Deloitte