Global EV Outlook 2023

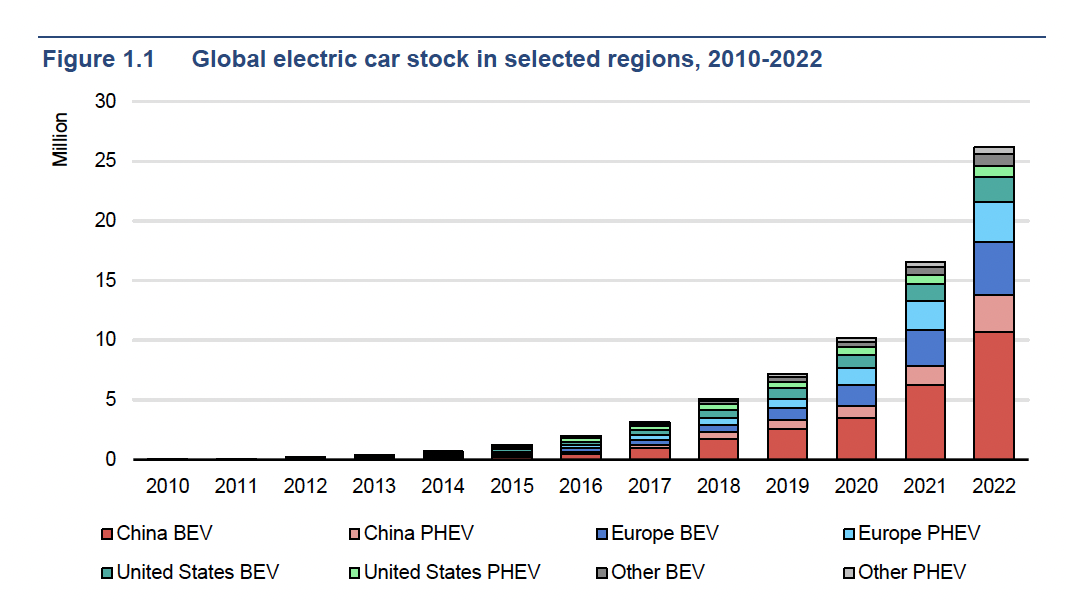

The IEA predicts that electric car sales will continue to grow through 2023, with an expected 14 million sales by the end of the year, representing a 35% year-on-year increase. Electric cars could account for 18% of total car sales for the year. The report also highlights promising growth in emerging electric vehicle markets, such as India, Thailand, and Indonesia.

Landmark EV policies are driving the outlook for EVs closer to climate ambitions

The IAE’s projections show that the share of EV sales will increase to 35% by 2030, with China being the largest market, the US doubling its market share, and Europe maintaining its current share.

This shift towards EVs will have profound implications on energy markets and climate goals. The European Union and the US have passed legislation to match their electrification ambitions, and battery manufacturing is expanding to meet the demand for EVs. The outlook is positive, and higher shares of sales are possible than those anticipated by current government policy and national targets.

As spending and competition increase, a growing number of more affordable models come to market

The global spending on electric cars reached over USD 425 billion in 2022, with 90% of the spending coming from consumers. The number of available electric car models has doubled to 500 since 2018, but affordable options are still needed outside of China to enable mass adoption. SUVs and large cars dominate the electric car market with their large batteries requiring more critical minerals.

Despite this, electric SUVs displaced over 150,000 barrels of oil consumption per day in 2022, resulting in net emissions reductions. Investors remain confident in EVs, and venture capital investments in start-ups developing EV and battery technologies reached nearly USD 2.1 billion in 2022.

Focus expands to electrification of more vehicle segments as electric cars surge ahead

The electrification of road transport is expanding beyond cars, with two or three-wheelers being the most electrified market segment today, particularly in emerging markets and developing economies. The commercial vehicle stock is also seeing increasing electrification, with electric light commercial vehicle sales worldwide increasing by more than 90% in 2022.

Electric bus sales reached high shares in countries where governments have committed to reducing emissions from public transport. Ambition with respect to electrifying heavy-duty vehicles is also growing, with 27 governments pledging to achieve 100% ZEV bus and truck sales by 2040.

EV supply chains and batteries gain greater prominence in policy-making

The increase in demand for electric vehicles is leading to a growing demand for batteries and critical minerals. In 2022, automotive lithium-ion battery demand grew by 65% to 550 GWh, mainly due to the growth in electric passenger car sales. This also drove the growing demand for lithium, cobalt, and nickel.

The EV supply chain is expanding, but manufacturing is highly concentrated in certain regions, with China being the main player in battery and EV component trade. New alternatives to conventional lithium-ion batteries are also emerging, such as lithium-iron-phosphate (LFP) chemistries and sodium-ion batteries.

EV supply chains are increasingly at the forefront of EV-related policymaking to build resilience through diversification. The European Union’s proposed Net Zero Industry Act aims for nearly 90% of the EU’s annual battery demand to be met by EU battery manufacturers, and India is boosting domestic manufacturing of EVs and batteries through Production Linked Incentive (PLI) schemes. The United States’ Inflation Reduction Act aims to strengthen domestic supply chains for EVs, EV batteries, and battery minerals, and major EV and battery makers have announced cumulative post-IRA investments of at least USD 52 billion in North American EV supply chains.

Get ‘free of charge’ access to more than 250 valuable EV Market Insights via www.EVMarketsReports.com, the world’s largest e-Mobility Reports and Outlooks database. Enjoy reading!